Opinionated workspace for discretionary futures traders

Stop trading vibes. Start trading planned R.

Clarity has you map supply/demand zones before the bell, then use the Trade Planter to prospect ideas on those zones, see their true expected R, and auto-size contracts off your dollar-per-R risk—so you only execute trades that actually belong in your playbook.

Email capture is temporarily paused while we switch queue backends. Submissions are disabled.

We'll only reach out when Clarity is ready. Already using it? Sign in.

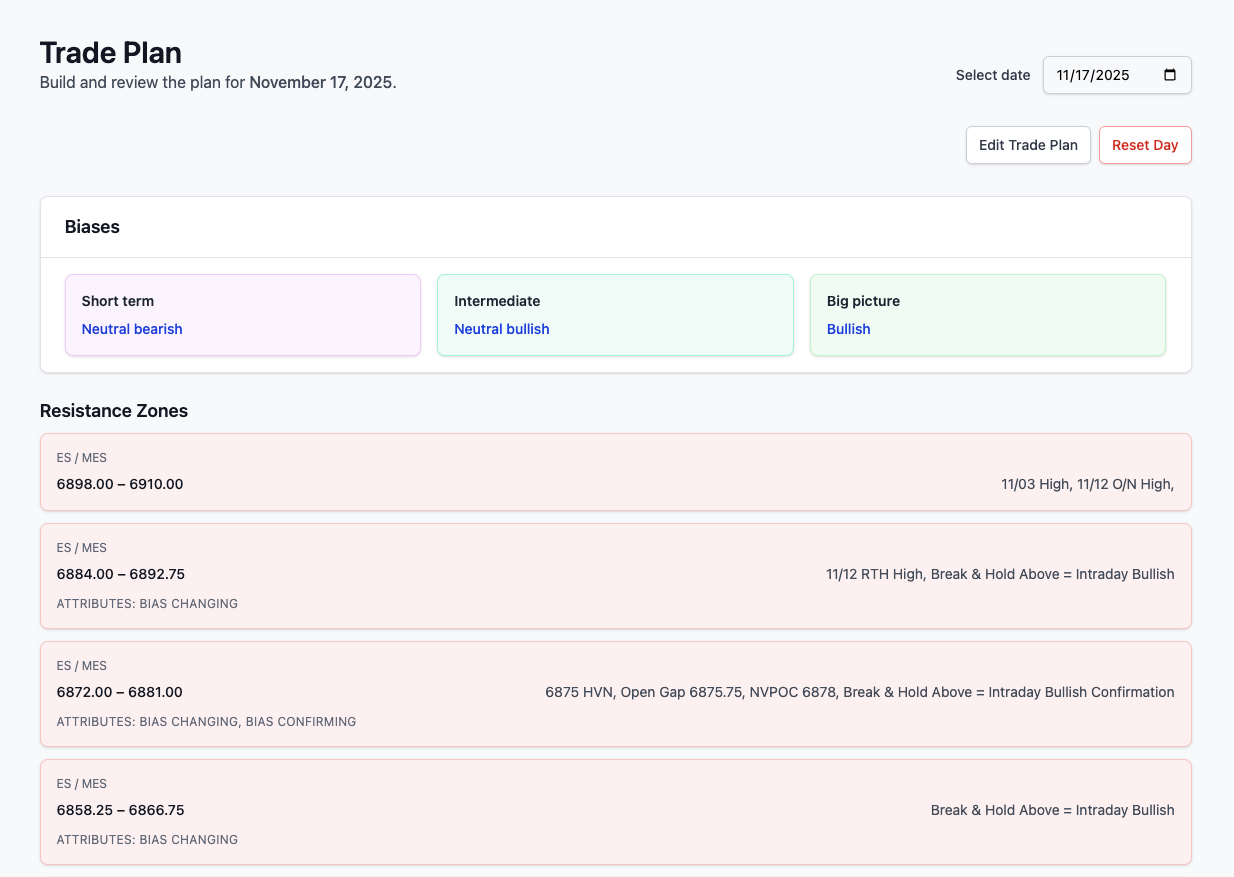

Daily trade planning

Start every session with an objective blueprint.

Biases, session notes, and instrument-specific zones captured before the open. Drag-and-drop ordering and clear attributes keep prep consistent and enforce single-instrument or pair assignments.

Everything feeds your R profile so the planter downstream stays honest.

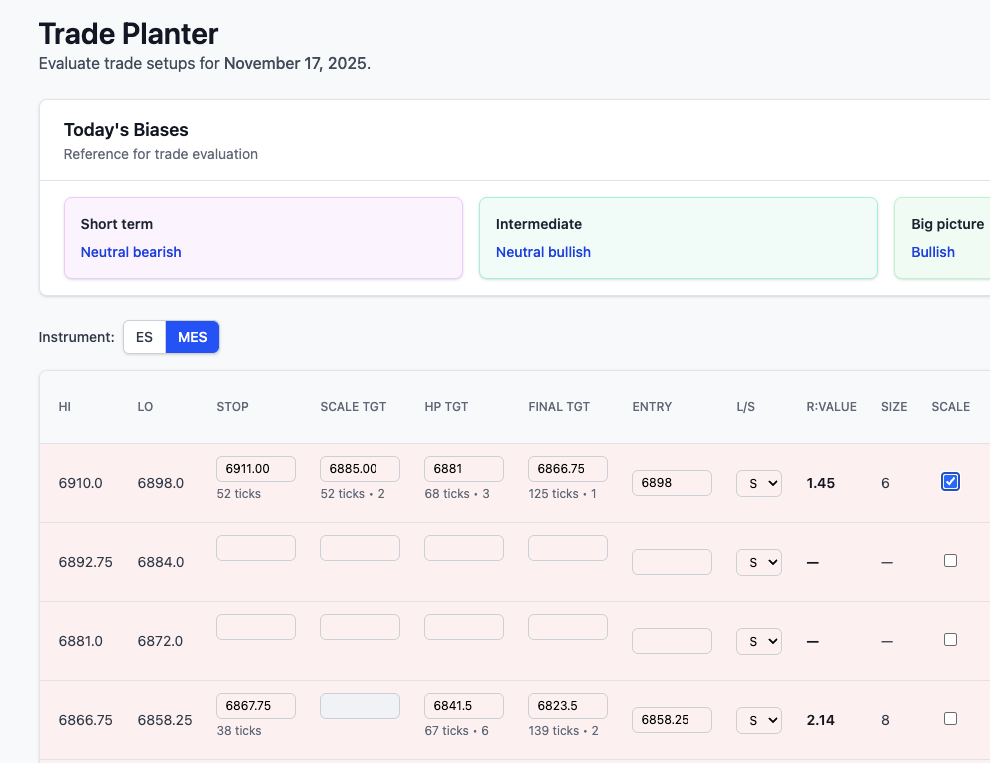

Trade planter

Turn zones into executable setups.

Automatically calculates stops, targets, ticks, and position sizes using your saved R value. Weighted R-multiple outputs show the expected payoff before risk capital is exposed.

Quadrant checkboxes and one-click "Mark trade taken" push fills into the API-backed journal—no context lost.

Defaulting to R multiples keeps you focused on process, not P&L swings.

🔜 Trade journal · Coming soon

Close the loop between plan and execution.

Filter by date range, review win rate and P&L trends, and compare actual fills to the expected R multiple. Color-coded outcomes and bias tags make post-trade review fast.

Coming soon—drop your email to get early access updates.

Opinionated risk layer

Discipline by default.

Built-in guardrails ensure every decision stays anchored to your risk framework.

Guardrails that keep data clean

Unsaved-change warnings, instrument selectors that prevent orphaned zones, and PDF imports to pull in your pre-market notes without losing structure.

Risk settings that travel with you

R value and target percentages must sum to 100%—no fuzzy math. Every calculator and execution flow uses the same settings.

API-ready from day one

Bearer-token API for current plans and trade ingestion means your automation speaks the same R-multiple language.

Process over vibes

By framing everything in multiples of risk, Clarity removes P&L dollar swings from decision-making.